The key to return

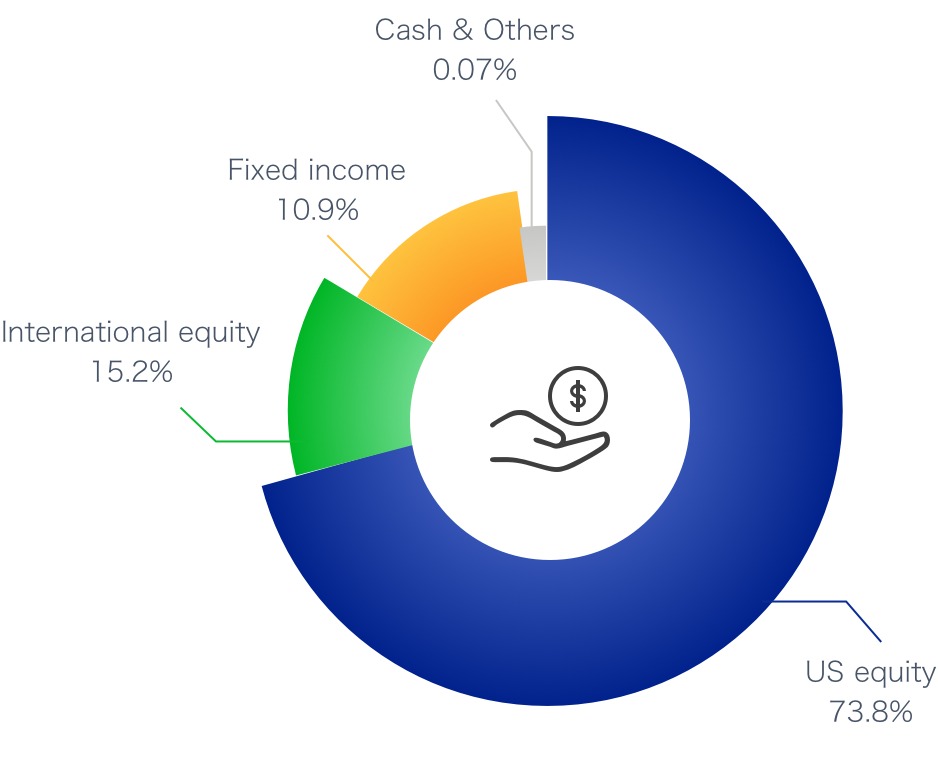

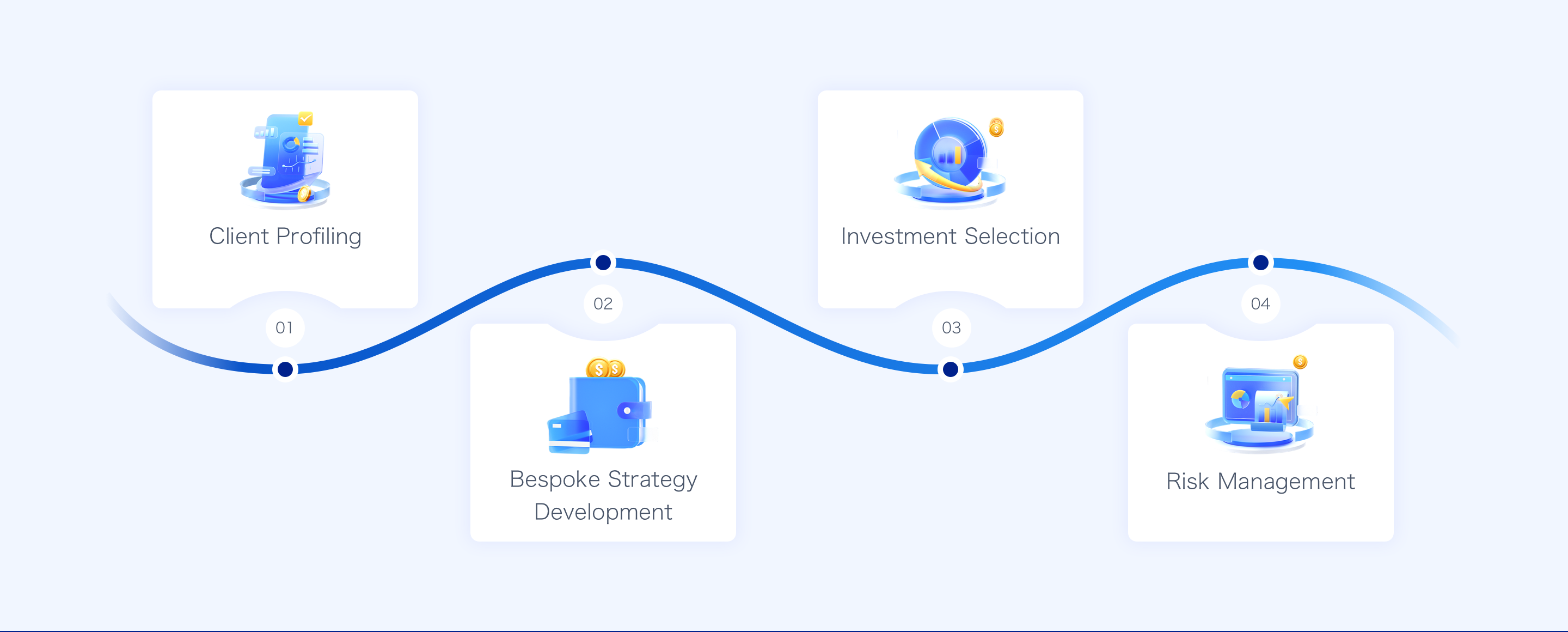

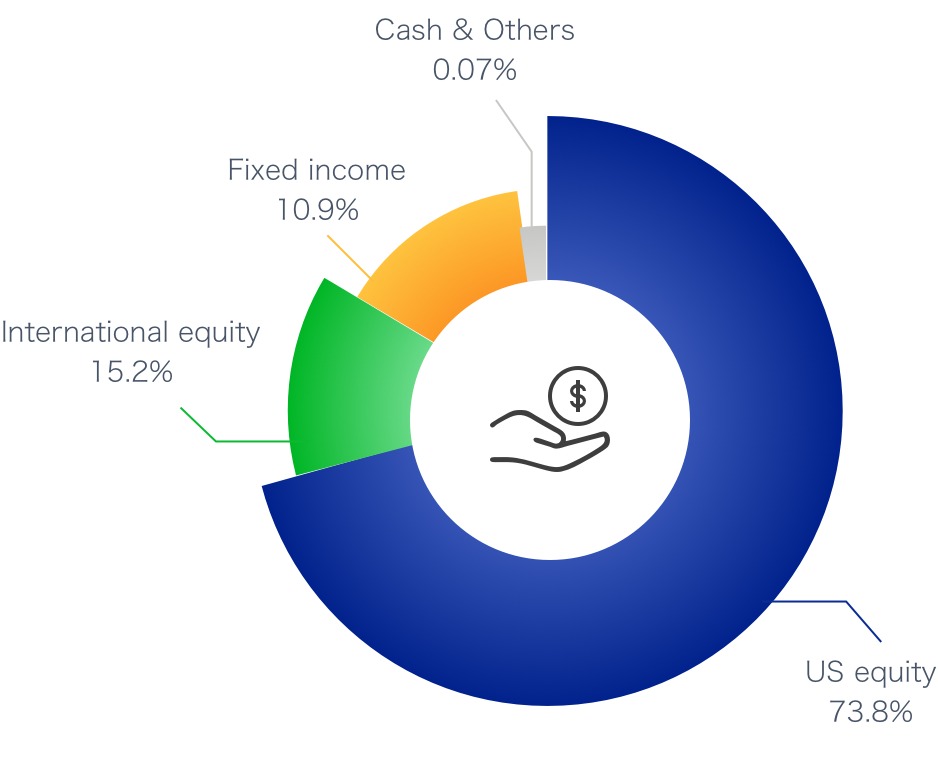

Academic and practitioner studies consistently show that over 90% of long-term portfolio returns are explained by asset allocation, not security selection. Our job is to optimise that allocation to provide you with attractive long-term returns while managing the risks.

Matching your goal

Multi-asset portfolios can invest in a broad investment universe. We conduct systematic research to identify the asset classes that match your investment goals, your target risk profile and liquidity requirements.

Diversification

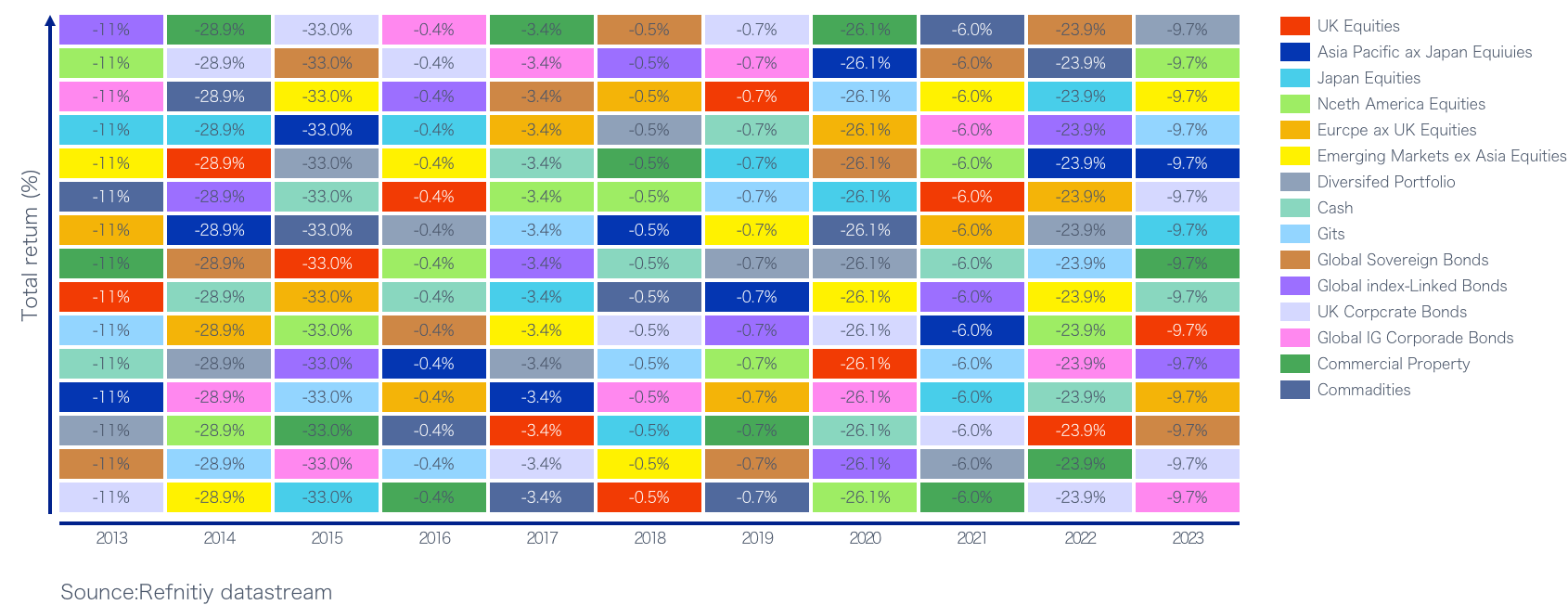

The chart below shows the returns of different asset classes over the past 10 years.

No single asset class performs well all the time.

By carefully choosing asset classes at different points in time, we aim to run a portfolio that can deliver long-term performance with a smoother return profile.

| Category | Details |

|---|---|

| Objective | Maximise long-term capital growth |

| Typical Allocation | 85-100% equities, 0-15% cash |

| Risk Level | High |

| Return Benchmark | MSCI World |

| Volatility | High-sensitive to equity market swings |

| Best For | Investors with long-term investment horizons, ambitious return goals, and strong risk tolerance |

| Category | Details |

|---|---|

| Objective | Generate stable, recurring income with modest capital growth |

| Typical Allocation | Income-generating assets (dividend equities, bonds, REITs, preferreds); ~70% equities, ~30% fixed income |

| Risk Level | Low–Medium |

| Volatility | Moderate – income can buffer price volatility |

| Best For | Investors who want regular distributions |

| Category | Details |

|---|---|

| Objective | Balanced growth and capital preservation through strategic asset diversification |

| Typical Allocation | ~70% equities, ~30% fixed income |

| Risk Level | Medium |

| Volatility | Medium – diversified across asset classes |

| Best For | Investors seeking growth with controlled drawdowns and regular rebalancing |

| Category | Details |

|---|---|

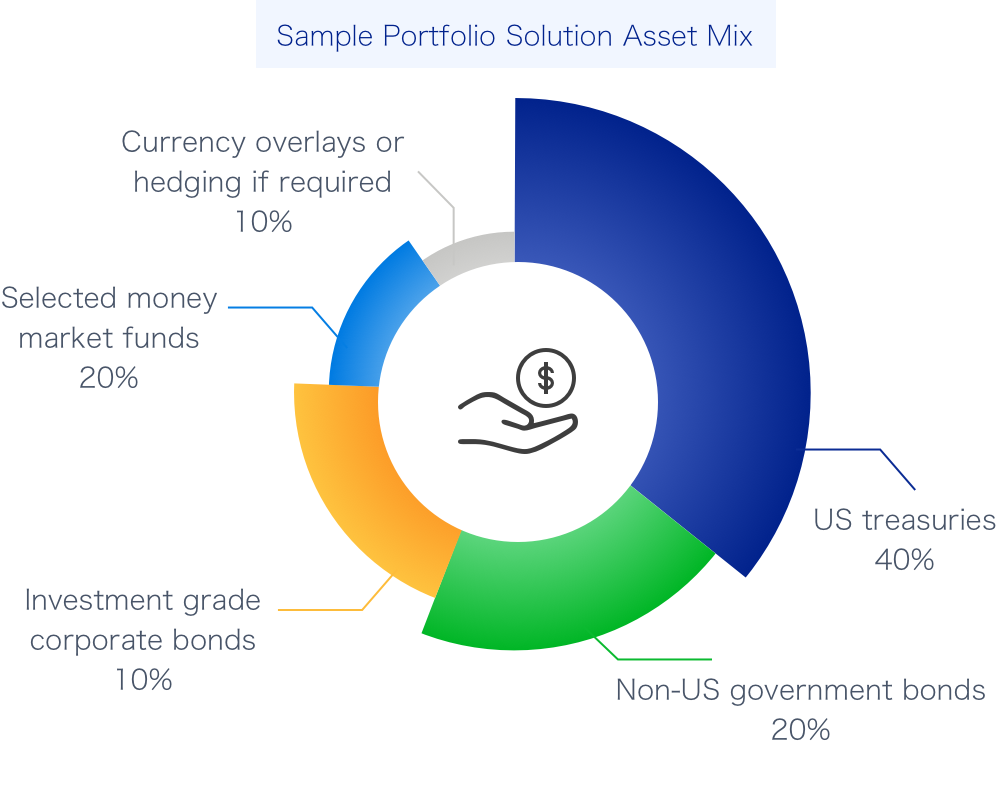

| Objective | Capital preservation and low-volatility yield |

| Typical Allocation | 100% bonds (money market funds, government bonds, corporate bonds and other fixed income instruments) |

| Risk Level | Low |

| Volatility | Low – but sensitive to rate and credit cycle |

| Best For | Investors with short-term cash needs, conservative profiles, and liability-driven planning |